Just when you thought the election of Scott Bessent as secretary of the Treasury Department had tamped down the “tariff tensions” in the market, President-elect Trump reminded everyone responsible for drugs and open borders tonight.

In a statement on his Truth Social account, Trump twisted the hammer against Mexico, Canada…

“As everyone knows, thousands of people are flowing through Mexico and Canada, bringing crime and drugs to levels never seen before.

At the moment, it seems that a caravan from Mexico, made up of thousands of people, is unstoppable in its quest to come through our current open border.

On January 20, as one of my many first executive orders, I will sign all the necessary documents to demand a 25% tariff from Mexico and Canada on ALL products arriving in the United States and its ridiculous open borders.

This tariff is valid as long as drugs, especially fentanyl and all illegal aliens, stop this invasion of our country! Both Mexico and Canada have the absolute right and power to easily solve this long-standing problem.

We hereby demand that they use this power, and until they do so, it will be time for them to pay a very high price!”

… and, of course, China…

“I’ve had a lot of talks with China about huge amounts of drugs, especially fentanyl, being sent to the United States – but to no avail.

The Chinese representatives told me that they would impose their maximum sentence, the death penalty, on all the drug dealers who would be caught doing so, but unfortunately they never followed it, and drugs are flowing into our country, mainly through Mexico, at a level that has never been seen before.

Until they expire, we will demand an additional 10% tariff from China, which exceeds any additional tariffs, on all these many products coming to the United States.

Thank you for your attention to this issue.”

Recall that fentanyl, a powerful synthetic opioid, has been linked to about 100,000 deaths a year in the United States, with much of the lethal drug flow coming from the southern part of the border.

A damning report released earlier this year by the U.S. House of Representatives Select Committee on Strategic Competition between the United States and the Chinese Communist Party found that the Chinese regime is encouraging the spread of fentanyl in the United States.

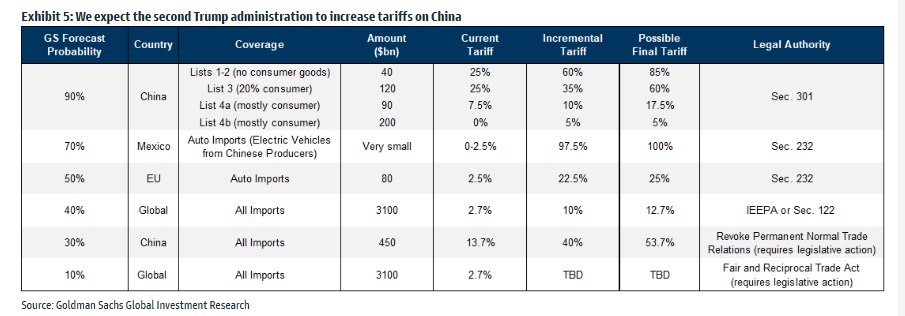

In addition, Trump has previously vowed to end China’s most-favoured-nation trade status and impose tariffs on Chinese-made goods in excess of 60 percent.

The initial reaction to Trump’s threatening posts was a rise in the dollar, erasing weekend losses (after Bessent’s meeting) with peso and loonie, both of whom tumbled along with the offshore yuan…

Stocks also fell in Japan, Australia and South Korea, with U.S. futures modestly higher. Goldman’s research team argues that this FX reaction is perhaps a little overblown:

It seems to be easier compared to what the market has generally expected … and the less obscure choice of the Treasury chief also said it would roll out tariffs in layers (meaning the 10% trump mentioned just now is indeed a start, but still milder than market expectations).

Their basic expectation remains (via Goldman’s Hui/Lisheng/Xinquan):

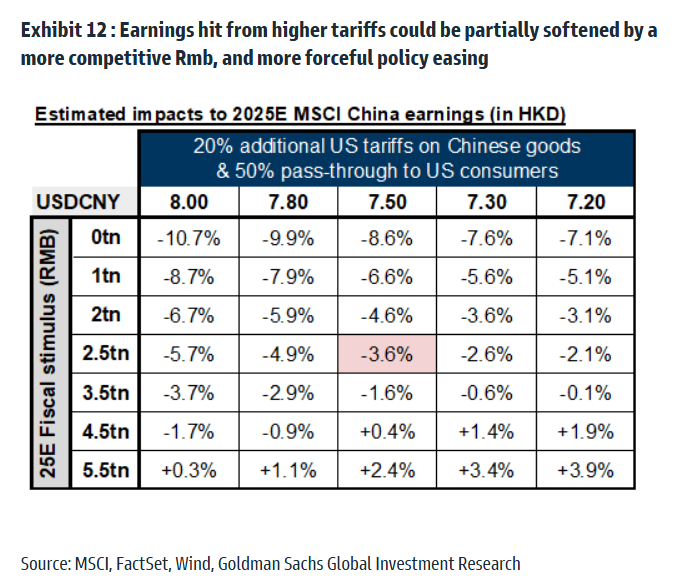

- Suppose additional U.S. tariffs on Chinese goods by 20% in 2025, we expect USDCNY to rise to 7.4/7.5 in 3/6 months, continued RRR/policy rate cuts, and an increased budget deficit to increase by 1.8pp of GDP in 2025 compared to 2024;

- While our growth forecast for 2025 (4.5%) is in line with consensus, our inflation projections are significantly below (CPI 0.8%; PPI 0.0%);

- We assume that exports will be relatively stable, real estate investment will continue to decline, and consumption (especially the consumption of goods) will outperform. Growth in government consumption and investment is likely to accelerate.

According to Goldman analysts, the impact on MSCI’s Chinese revenue would be as follows:

While they claim it feels softer than expected, the lack of detail means the actual impact is still uncertain.