Ocean freight transit times from Shanghai to Los Angeles typically range from 14 to 40 days, and faster services – such as CMA CGM’s expedited routes – deliver containers in as little as three weeks. With most imports from China now subject to 145% tariffs, the full economic impact is likely to be delayed by about a month or more as import volumes and supply chain disruptions take hold. Early high-frequency indicators already suggest that these disruptions are imminent.

Let’s review the main developments in the trade war after President Trump announced an increase in tariffs on Chinese imports to 145% on April 11, following “Liberation Day” on April 2.

- Amazon cancels orders, Walmart pulls forecast as tariffs take hold

- Will China’s highway traffic indicators collapse as tariff war cancels factory orders?

- Chinese Sellers Panic on Amazon After Trump’s Tariff Bazooka

- Liberation Day Fallout: China’s port volumes sink after Trump’s tariff push

- Chinese plastics factories face mass closures as US ethane supplies evaporate

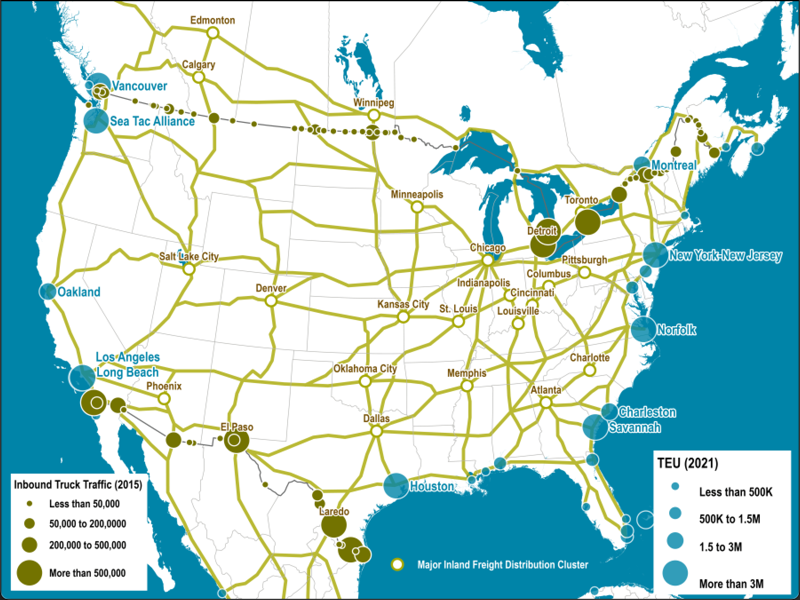

On Wednesday, new data from Port Optimizer, a tracking system for ship operators, showed that planned import volumes at the Port of Los Angeles are expected to decline sharply starting Sunday.

Adding to the conversation, FreightWaves CEO Craig Fuller X’s post says that freight activity at the Port of LA, the largest container port in the Western Hemisphere, has just dropped…

“Year-over-year, freight traffic from Los Angeles is down 23%. It will likely fall to 50% in the coming weeks if the trade war is not resolved,” Fuller said.

He warned: “Massive layoffs are coming in the West Coast freight sector.”

The incoming disruption at Port LA will soon lead to a slump in container flows from China, which will ripple through the Southern California economy.

The error may occur as follows.

Reducing the volume of containers

- Volume decline: A decline in imports would reduce port capacity, disrupting operations whose profitability depends on consistent traffic.

- Revenue hit: The Port of LA, which generates revenue through container handling fees, leases and other port services, is expected to see a significant decline in revenue.

Job losses

- Dockworkers and terminal workers: ILWU hours will be reduced; possible layoffs or furloughs.

- Truckers and warehouse workers: Major layoffs in the Inland Empire’s vast logistics hub (Ontario, Riverside, etc.) – home to over 200 million square feet of warehouse space.

Broader economic recession (Southern California)

- The logistics sector is the largest private employer in the Inland Empire. A major drop in volume could collapse part of the warehousing economy.

Retail & Consumer Ripple Effects

- Higher costs and a shortage of imported goods would put pressure on both retailers and consumers.

Port diversions

- Shippers would increasingly divert to Mexican and Canadian ports, bypassing LA entirely.

- Companies could shift sourcing to Mexico or other non-tariff countries, reducing LA’s role as an import hub for China.

While the first wave of disruptions is emerging in Port LA and could soon spread across the Inland Empire and then the Heartland across the Pacific, high tariffs on Chinese goods have already disrupted factories in the world’s second-largest economy, according to a new report from the Financial Times:

Wang Xin, head of the Shenzhen Cross-Border E-Commerce Association, an industry group representing more than 2,000 Chinese merchants, said many of them were “extremely concerned” and had ordered factories and suppliers to suspend or delay deliveries. He said this had prompted some factories to suspend production for one to two weeks.

. . .

It is unclear how widespread the factory shutdowns are, said Han Dongfang, founder of China Labor Bulletin, which closely monitors Chinese manufacturing and labor. “The restructuring of China’s manufacturing sector is a long-term process, and workers will be sacrificed,” he said.

What is telling is that the Trump administration is preparing for an impact and has likely viewed this port data as new signs of a possible de-escalation in the trade war with China.

On Tuesday, Finance Minister Bessent told investors in a closed-door meeting: “Nobody thinks the current status quo is sustainable, 145% and 125%, so I expect there will be a de-escalation in the near future. We have an embargo on both sides right now.”

Bessent said earlier this week that it could take two to three years to conclude a trade deal.

President Trump has repeatedly stated that there will be a “minor disruption” and a “short-term disruption” when the tariffs go into effect.

The adjustment period seems to be approaching. Even before it fully arrives, Americans are already panicking about “American products.”

It is time to break the country’s dependence on cheap Chinese goods and rebuild critical supply chains — a crucial step toward securing economic dominance in 2030 and beyond. Without these supply chains that produce drones, smartphones, chips, electric vehicles, and humanoid robots (all under similar manufacturing ecosystems), it will be impossible to compete with China in the coming decades. The adjustment period is approaching.