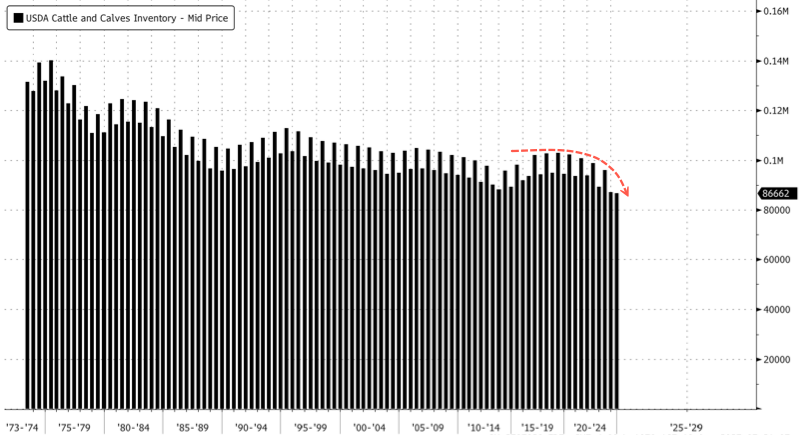

During Tyson Foods’ earnings call on Monday, Brady Stewart, the company’s head of beef and pork supply chains, offered fresh insight into a potential slump in U.S. beef inventories, which have fallen to their lowest levels in more than 70 years. His comments came in response to a question from a Wall Street analyst.

Barclays analyst Benjamin Theurer asked Stewart about the overall environment for the beef industry:

So it looks like you had just a small volume decline in the quarter that can be explained almost entirely by leap year and some calendar effects. So I just wanted to get a little bit more of a sense of what you’re seeing in terms of cattle supply and cost in your operation and what you think about the early signs that might indicate heifer retention? Is it breeding or not? So how should we just think about those throughout the cycle? Are we at the bottom or is it too early to tell? That would be my first question.

Stewart explained that while cattle supply is down year-over-year, record high animal weights are helping to offset the volume decline. He added that the U.S. cattle industry is likely at or near the bottom of its inventory cycle, with herd levels now at a 73-year low.

Here is the manager’s response to the Barclays analyst, which provides valuable information for consumers, ranchers and anyone who monitors the nation’s cattle stocks:

Ben, I think it’s important to note that feeder cattle are extremely heavy from a weight perspective. We’re also at record weight in our company. So we’re seeing some weight loss that’s offsetting from a volume perspective, partly because supply has been clearly lower than a year ago.

In terms of heifer stocking – and I would say this as Curt has mentioned before – if we are not at the bottom in terms of cow numbers, we are certainly seeing that here. And I think a couple of points of reference behind that is certainly that we have seen an extreme decline in beef cattle numbers, almost 18%.

And on top of that, we’ve seen a decline in the number of heifers that are getting feed, which means that if the heifers aren’t on feed, the farmers and ranchers are keeping them. And we’re also seeing a 4% decline in heifer numbers year over year. So I think the signs are that we’re starting to see a recovery. And from a culling perspective, we’re also seeing a bottom at that point.

Earlier this year, the U.S. Department of Agriculture’s annual cattle inventory report revealed that the nation’s cattle population had fallen to a 73-year low, totaling about 86.6 million head.

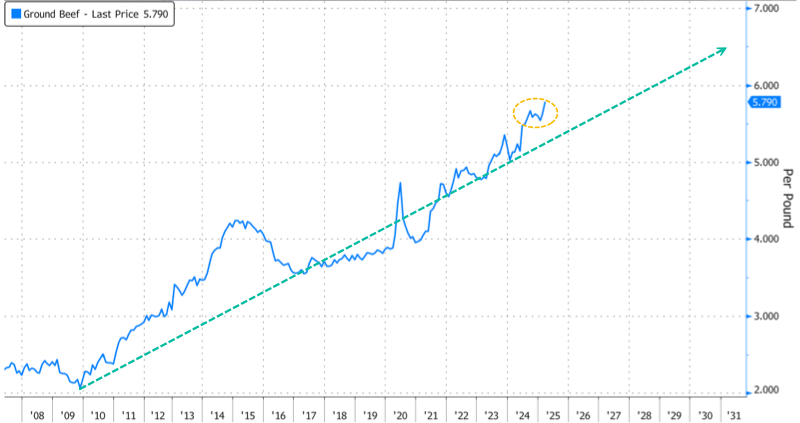

In supermarkets, USDA data from late March showed that the average price per pound of ground beef hit another record high of $5.79.

Stewart’s remarks were echoed by Texas Slim, founder of The Beef Initiative, who said:

“Herd recovery requires more than predictions – it requires proof of work. Ranchers who hold back heifers aren’t chasing trends; they’re investing in land, genetics and heritage. This 18% decline in beef yield is not a collapse – it’s a recalibration. If this is a bottom, it’s one that only true producers can build on.”

Slim said:

“Rebuilding America’s cattle herd will take years – and most importantly, it must involve the participation of family farm owners across the country. The current model, dominated by four multinational meat companies, is unsustainable on national security grounds.”

And continued:

“The most effective way to support this restoration effort is one order at a time through the ZeroHedge Rancher Direct Store. Last week’s product launch in partnership with ZeroHedge was a huge success. Now that the Make America Whole Again (MAHA) movement is gaining momentum, the connection between independent ranchers and consumers should grow stronger than ever.”

Every order puts working capital into American family ranchers who provide pure MAHA beef.

It’s time for a food revolution.